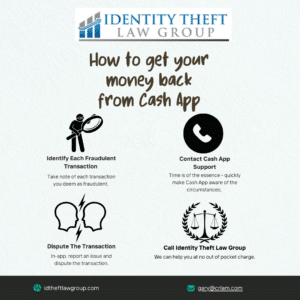

How to get your money back from Cash App

If you have had money stolen from your bank through your Cash App, you may be able to get it back. It really will depend on things including how quickly you notify Cash App of the fraud. (Sooner is far better than later). We handle a lot of these disputes for our clients on a no out of pocket basis. Under the law, Cash App has to pay our fees and costs when we are successful, which we usually are.

If you have been scammed out of money from your Cash App, here is what you need to do now

-

Identify each fraudulent transaction

First, determine the nature of the problem:

- Unauthorized Transactions: If you notice charges you didn’t authorize, you may be dealing with fraud. These kinds of transactions are recoverable from the bank.

- Scams: If you were deceived into sending money to a scammer, this falls under a scam transaction. These kinds of transactions are also recoverable from the bank.

- Payment Errors: Sometimes, payments are sent to the wrong person due to a mistake in entering details. This kind of error is not the bank’s fault and it’s unlikely you will get your money back.

-

Contact Cash App Support Immediately

Time is of the essence when dealing with fraudulent transactions. Follow these steps to contact Cash App support:

- Open Cash App: Navigate to your profile by tapping the account icon.

- Select Support: Scroll down and select “Cash Support” followed by “Something Else.”

- Describe the Issue: Select the issue closest to your problem and provide a detailed description. For unauthorized transactions or scams, make it clear in your description and emphasize the urgency of the situation.

-

Dispute the Transaction

If contacting support doesn’t yield immediate results, you can dispute the transaction. Here’s how:

- Navigate to the Activity Tab: Find the specific transaction you wish to dispute.

- Tap the Transaction: Select the transaction and tap on the three dots in the upper-right corner.

- Report an Issue: Choose “Need Help & Cash App Support” and then “Dispute this Transaction.”

Provide as much detail as possible to support your claim, including screenshots or any communication with the scammer.

-

Contact Your Bank or Card Issuer

If your Cash App account is linked to a bank account or debit/credit card, report the fraudulent activity to your bank or card issuer. Most financial institutions offer fraud protection, and they can:

- Freeze Your Account: To prevent further unauthorized transactions.

- Investigate the Fraud: Your bank may open an investigation into the disputed transaction.

- Initiate a Chargeback: For debit or credit card transactions, you can request a chargeback, which reverses the charge.

Provide your bank or card issuer with all relevant details, including the Cash App dispute information.

-

Report the Fraud to Authorities

Filing a report with the appropriate authorities can help in reclaiming your funds and preventing future fraud. Consider:

- Local Law Enforcement: File a police report to document the fraud.

- Federal Trade Commission (FTC): Report the scam at IdentityTheft.gov.

- Internet Crime Complaint Center (IC3): This is part of the Federal Bureau of Investigation (yep…the FBI). If the scam occurred online, file a complaint with the IC3.

These reports can be useful in bolstering your claim with Cash App and your financial institution.

-

Monitor Your Accounts

While resolving the dispute, keep a close eye on your Cash App and linked financial accounts. Look for:

- Additional Unauthorized Transactions: Monitor for any further fraudulent activity.

- Communication from Cash App or Your Bank: Respond promptly to any requests for additional information.

-

Enhance Your Account Security

To prevent future fraud, enhance the security of your Cash App account:

- Enable Two-Factor Authentication: This adds an extra layer of security.

- Use a Strong, Unique Password: Avoid using easily guessable information. The days of “12345” are long gone. Don’t even think about “ABCDE”

- Regularly Monitor Transactions: Check your account activity frequently. It’s not hard to do since you can check on your phone.

Don’t get stuck paying charges that don’t belong to you. Call us today.

Call our law firm at Identity Theft Law Group at (404) 591-6680. We have attorneys in ten states that can help you with your credit card disputes at no out of pocket charge to you. You work too hard for your money and should not get stuck paying charges that are not yours. You can also email us at [email protected]. Call or email us today.

(404) 591-6680